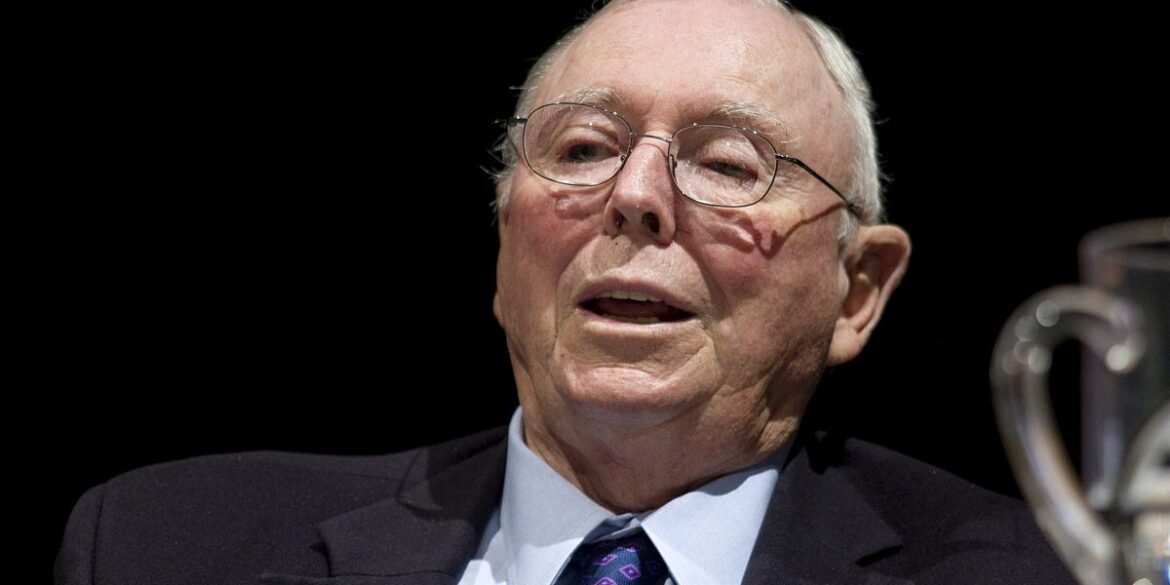

Charlie Munger, Warren Buffett’s right-hand man at Berkshire Hathaway, marveled earlier this year at the success of China’s BYD. The electric-vehicle maker has trounced Tesla in China and is close to overtaking it in EV sales globally, as well. Munger led Berkshire’s decision to invest in BYD.

“I have never helped do anything at Berkshire that was as good as BYD,” Munger said in February at the annual meeting of news publisher Daily Journal. “BYD is so much ahead of Tesla in China. It’s almost ridiculous.”

Munger said that Berkshire’s initial $270 million investment in BYD, made in 2008, was “worth about $8 billion or maybe [$9 billion]. That’s a pretty good rate of return.”

A big reason for BYD’s success, Munger believes, is the caliber of its founder and CEO Wang Chuanfu, whom he described as a “combination of Thomas Edison and Jack Welch” in 2009. Recently, he elaborated further on the qualities of the billionaire BYD founder, who grew up in extreme poverty, having been born to rice-farmer parents then orphaned as a child.

“He can do things you can’t do,” Munger said on a Sunday episode of the podcast Acquired. “He’s a fanatic that knows how to actually make things with his hands. He’s closer to ground zero in other words. The guy at BYD is better at actually making things than Elon is.”

Describing the investment in the Chinese automaker as a “venture-capital type play,” he added, “BYD was a miracle, but that guy worked 70 hours a week and has a very high IQ.” Wang is also known to be a relentless cost-cutter, and he still lives a relatively frugal lifestyle.

Brent Lewin/Bloomberg via Getty Images

Yes to BYD, no to Tesla

Munger was also pitched by Musk about Berkshire investing in Tesla, but Munger decided against it. In a dig at Munger, Musk tweeted earlier this year, “Munger could’ve invested in Tesla at ~$200M valuation when I had lunch with him in late 2008.” The implication was that Munger could have made even more money on Tesla, whose market cap is now at $679 billion, than with BYD.

But Berkshire, with some exceptions, has avoided investing in automakers, deeming it too risky. As Buffett explained earlier this year: “Charlie and I for long have felt that the auto industry is just too tough. It’s just a business where you’ve got a lot of worldwide competitors, they’re not going to go away. And it looks like there are winners at any given time, but it doesn’t get you a permanent place.”

He continued, “I think I know where Apple’s going to be in five or 10 years, [but] I don’t know what the car companies are going to be in five or 10 years.”

In the Acquired podcast, Munger said, “Who’s going to win, who knows? The whole thing’s been thrown way up in the air by all these electric cars, all these big new capital requirements, different ways of selling cars, and plus they’ve got these tough unions, so I just don’t even look at the auto industry.”

Even BYD makes him nervous today, despite its success. Berkshire has been selling BYD shares since August last year, including $25.7 million worth last month.

“I may be a big fan, but I’m sort of hanging on by my hat while they lurch around the track,” he said. “They make me nervous, it’s so aggressive.” He described “huge mistakes” BYD made in its early days, when it “almost went broke with their early dealership building system.”

But asked what captivated him about BYD, Munger replied: “The guy was a genius. He had a PhD in engineering and he could look at somebody’s part in the morning…and in the afternoon he could make it. I’ve never seen anybody like that. He can do anything. He is a natural engineer and a get-it-done-type production executive, and that’s a big talent to have in one place.”

It helps explain why BYD, which makes its own batteries and semiconductor chips, came just 3,456 vehicles shy of overtaking Tesla in global EV sales in the third quarter and is poised to overtake it. BYD sold 431,603 fully-electric vehicles in the quarter, up 23% from the previous quarter.

“BYD will sell more fully electric passenger vehicles than Tesla in the fourth quarter,” Taylor Ogan, CEO of Shenzhen-based hedge fund Snow Bull Capital, which owns shares in both automakers, told Bloomberg last month.

While it’s known for selling affordable vehicles to the masses, BYD recently introduced luxury brands to its lineup, helping fuel its sales surge. It’s also selling more cars abroad—particularly in Europe and Southeast Asia—with exports accounting for 9% of third-quarter sales, up from 5% in the previous quarter.

In May, Musk responded to a resurfaced 2011 interview showing him laughing at the quality of BYD cars.

“That was many years ago,” Musk explained. “Their cars are highly competitive these days.”